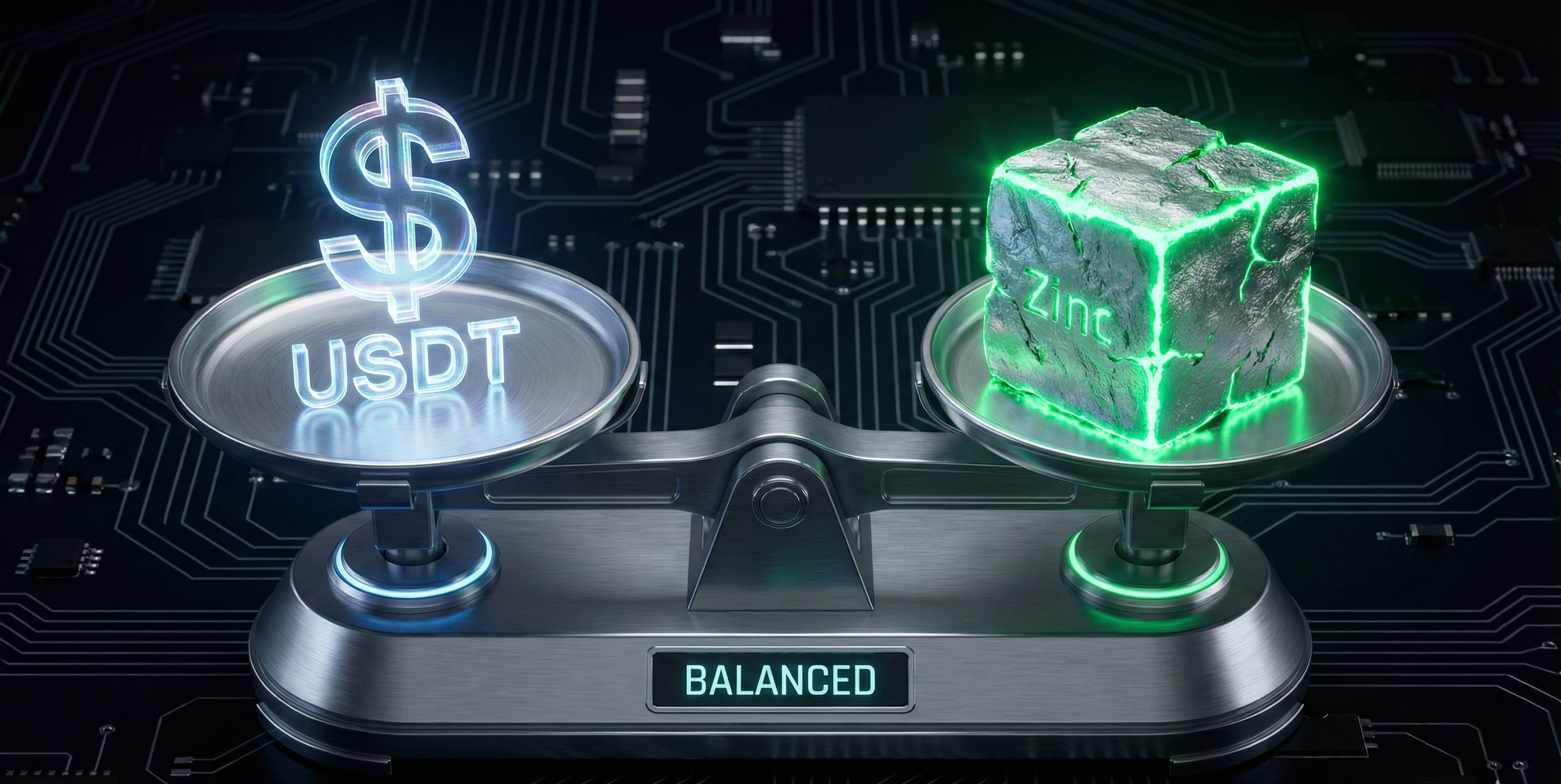

For years, Tether (USDT) has been the undisputed king of stablecoins. It provided a necessary safe harbor from crypto volatility, allowing traders to park their funds in a digital asset pegged to the US Dollar. But as we move towards 2026, smart investors are asking a critical question: Is pegging your wealth to a depreciating fiat currency truly "safe"?

The landscape is shifting towards **Real-World Assets (RWAs)**. This article compares the traditional fiat-backed model of USDT with the innovative, commodity-backed model of ZNST (Zinc Stable Token), and why your portfolio needs tangible backing.

The Problem with Fiat-Backed Stablecoins (USDT)

Tether does an excellent job of maintaining a $1 peg. However, the $1 it is pegged to is constantly losing purchasing power due to inflation. While your USDT balance remains numerically stable, its real-world value quietly erodes over time.

Furthermore, fiat-backed stablecoins rely heavily on traditional banking systems for their reserves, introducing centralized risks that DeFi was meant to solve.

The ZNST Solution: Stability with Intrinsic Value

ZNST is not pegged to a central bank's promise; it is pegged to **Zinc**, an essential industrial metal. This fundamentally changes the value proposition:

1. Hedge Against Inflation

Historically, commodities like metals hold their purchasing power far better than fiat currencies during inflationary periods. When the dollar weakens, hard assets often strengthen.

2. Driven by Industrial Utility, Not Speculation

The value of Zinc isn't imaginary. It is demanded globally for infrastructure (galvanized steel), construction, and the rapidly expanding electric vehicle (EV) battery market. ZNST has a real-world "floor price" supported by global industry.

3. True Decentralization

By tokenizing physical reserves on the TRON blockchain, ZNST reduces reliance on opaque traditional banking layers, offering a more transparent form of stability.

Head-to-Head Comparison

| Feature | Tether (USDT) | ZNST (Zinc Token) |

|---|---|---|

| Backing Asset | Fiat Currency (USD) & equivalents | Physical Industrial Zinc |

| Inflation Impact | Loses purchasing power annually | Historic hedge against inflation |

| Value Driver | Central Bank Policy | Global Industrial Demand |

Conclusion: It's Time to Upgrade Your Stablecoin

USDT was crucial for Crypto 1.0. But Crypto 2.0 is about Real-World Assets. Don't just hold stable numbers; hold stable *value*.

If you are holding excess USDT, now is the time to diversify into an asset with true utility. Use our instant swap feature to convert your Tether to ZNST today.