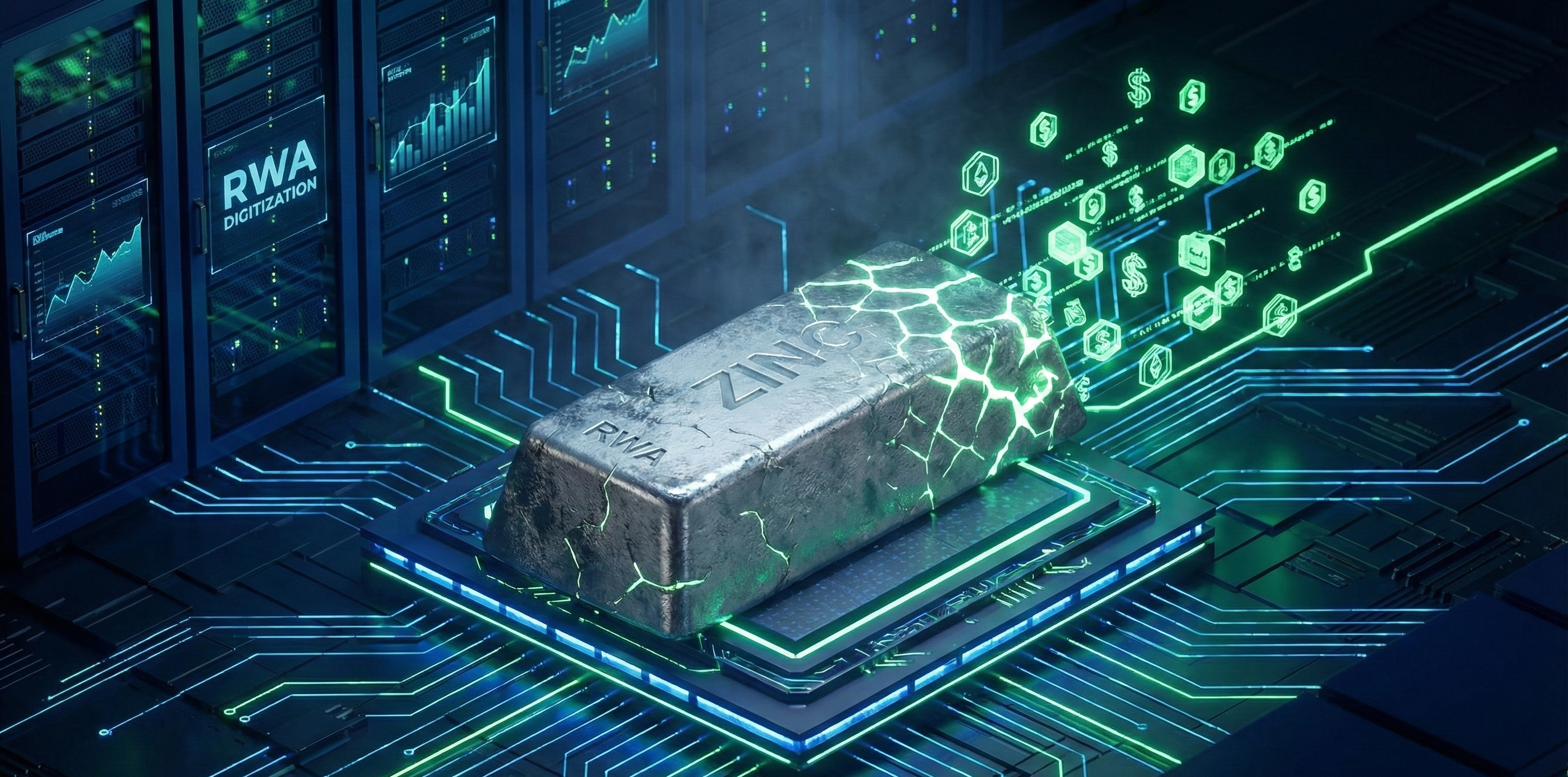

The cryptocurrency market is maturing. Gone are the days when meme coins and speculative hype alone drove the narrative. As we approach the end of 2025, a new giant has awakened, bridging the gap between Traditional Finance (TradFi) and Decentralized Finance (DeFi). We are talking about Real-World Assets (RWAs).

For long-term investors tired of market volatility, the tokenization of physical commodities represents the holy grail of stability and growth. Here is why the RWA revolution is here to stay, and why Zinc is the smartest entry point for your portfolio.

What Are Real-World Assets (RWAs)?

RWAs are digital tokens that represent physical or traditional financial assets on the blockchain. This can range from real estate and government bonds to commodities like gold, copper, and zinc. By tokenizing these assets, we bring liquidity, transparency, and accessibility to markets that were previously difficult for the average investor to enter.

Why RWAs Are the Future of Crypto in 2026

- Stability vs. Volatility: Unlike algorithmic tokens backed by nothing but code, RWAs are backed by tangible value.

- Utility: Commodities have industrial use cases. Their value isn't speculative; it is driven by global supply and demand.

- Institutional Adoption: Major global banks are now moving trillions of dollars onto the blockchain via RWAs.

The Case for Industrial Metals: Why Not Just Gold?

While Gold has always been a store of value, it lacks the aggressive industrial demand that drives growth. This is where industrial metals come in. However, not all metals are created equal.

Enter Zinc. Often overlooked, Zinc is the fourth most used metal in the world. It is essential for galvanizing steel (infrastructure), die-casting, and most importantly, next-generation battery technology.

Why Smart Money is Moving to Tokenized Zinc (ZNST)

Investing in physical zinc requires warehouses, logistics, and insurance. Investing in zinc futures requires complex brokerage accounts. Tokenized Zinc (ZNST) solves this.

1. Finite Supply, Growing Demand

With global infrastructure projects booming and the EV (Electric Vehicle) market expanding, the demand for zinc is skyrocketing. However, supply is constrained due to mine closures and environmental regulations. Economics 101 tells us: when demand goes up and supply goes down, prices rise.

2. The Stability of Zinc

Zinc offers a unique balance. It is less volatile than crypto assets but offers better growth potential than stagnant bonds. It is the perfect hedge against inflation.

3. Seamless Accessibility

Through the ZNST Protocol, you can own a fraction of zinc reserves instantly. No paperwork, no storage fees, just pure asset-backed value in your wallet.

Conclusion: Don't Miss the Wave

The crypto winter is over, but the era of "gambling" is also fading. The future belongs to assets with real utility. The RWA revolution is not just a trend; it is the inevitable evolution of finance.

Are you ready to secure your portfolio with the metal that builds the modern world? Start your journey with Zinc Stable Token today.